Realigning America's Drug Prices - A $240 Billion Opportunity Hiding in Plain Sight

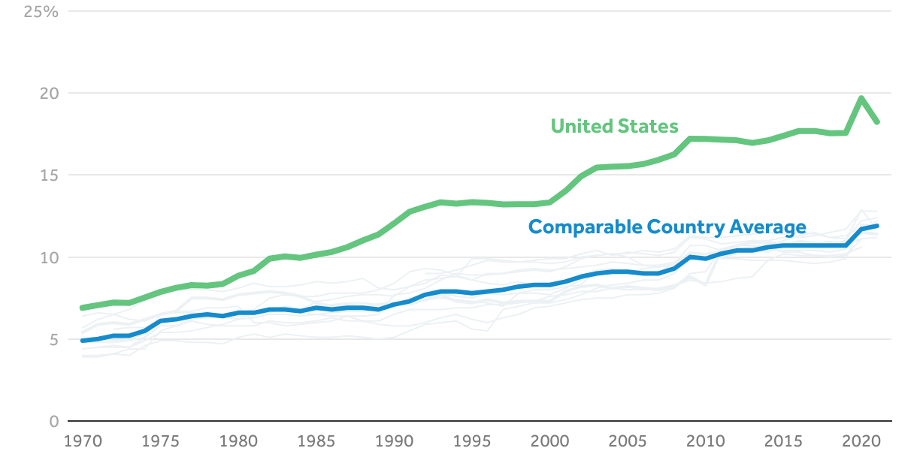

Source: KFF Analysis of National Health Expenditure (NHE) and OECD Data

Retail prescription drugs now account for roughly 10% of total U.S. healthcare spending, a share among the highest of peer countries — but at a much higher cost base.

Dr. Aaron Kesselheim of Harvard Medical School puts it plainly: "We are spending more than double what other countries pay, not because our care is better, but because we allow it."

What if the U.S. government paid fair prices — prices aligned with international norms? The reality is that the fiscal, policy, and health implications of realigning drug prices could save the United States (and taxpayers) up to $241 billion annually without sacrificing innovation or patient care.

The Anatomy of Overspending: Agency by Agency

Medicare: The Budgetary Behemoth

Medicare, the federal health insurance program for seniors, is the largest purchaser of prescription drugs in the United States. It Medicare Part D, which covers outpatient prescription drugs, accounted for $210 billion in gross spending in 2023. Medicare Part B, which includes physician-administered drugs like chemotherapy agents, reached $35 billion in spending — driven by high-cost biologics such as Keytruda and Prolia.

The 2022 Inflation Reduction Act marked a historic shift by authorizing Medicare to negotiate prices for select high-cost drugs — an effort expected to save nearly $100 billion over a decade. In 2023-2024, CMS released its first list of ten drugs subject to negotiation, including Eliquis, Jardiance, and Stelara. Together, these accounted for more than $50 billion in annual Medicare Part D spending — over 20% of program costs. By 2025, CMS is preparing for a second round of 15 drugs for negotiation, signaling broader reforms ahead.

Medicaid: Chronic Care at a Premium

Medicaid, the joint federal-state insurance program for low-income Americans, spends about $55 billion annually on prescription drugs. Despite mandatory rebates that reduce costs to around 64% of the average wholesale price, Medicaid faves substantial pressure from chronic disease therapies and hepatitis C treatments. Again, it is the taxpayer who ultimately funds these costs.

Recent data shows Medicaid spending on GLP-1 drugs for obesity and diabetes is accelerating rapidly. Several states have urged CMS for stronger rebate protections as GLP-1 coverage threatens to overwhelm state budgets.

Department of Veterans Affairs: A Model of Efficiency

The VA provides care for over 9 million veterans and spends roughly $8 billion annually on prescription medications. Thanks to aggressive negotiation and a streamlined mail-order system, the VA pays about 42% of average market prices — making it a standout in federal drug purchasing and a model for other agencies. This demonstrates that lower prices are possible with the right policies.

Yet, even the VA is now feeling pressure. In FY 2025, it requested an additional $2 billion to specifically cover the costs of weight-loss drugs such as Wegovy — evidence that no federal program is immune to the fiscal impact of this new class of therapies.

Department of Defense: Hidden in the Ranks

With a $55 billion annual health budget, the DoD delivers care through military treatment facilities and the TRICARE program. It benefits from federal pricing programs and discounts, yet comprehensive data on pharmaceutical spending remains opaque. Still, the potential for coordinated taxpayer savings is immense.

Other Federal Programs: Often Overlooked, Still Publicly Funded

While Medicare, Medicaid, the VA, and the DoD account for the vast majority of federal drug expenditures, smaller federal programs such as the Bureau of Prisons (BoP) and Indian Health Service (IHS) also purchase pharmaceuticals using public funds.

Bureau of Prisons (BoP): Provides medications for over 150,000 incarcerated individuals under the Department of Justice. Although the BoP's drug spending is much smaller — estimated in the hundreds of millions — it still represents a taxpayer-funded pharmaceutical expenditure.

Indian Health Service (IHS): Delivers healthcare, including prescription drugs, to roughly 2.6 million American Indians and Alaska Natives. While smaller in budget the IHS must negotiate costs amid systemic underfunding, and drug affordability is a critical issue.

These programs are not typically included in national drug spending summaries, but highlight that the reach of federal pharmaceutical spending is broader than commonly reported. Even beyond the core agencies, smaller federal healthcare programs further reinforce the reality that taxpayers shoulder the cost burden of inflated U.S. drug prices across virtually every corner of government care.

What Drives the Tab: Drug Class Breakdown

Biologics and Specialty Drugs

Biologics such as Humira (for arthritis) and Keytruda (for cancer) are among the most expensive drugs on the market, costing $77,000 and $150,000 annually per patient, respectively. These drugs represent one-third of all pharmaceutical spending and are expected to dominate future budgets.

Biologics such as Humira, Keytruda, and Prolia remain among the most expensive drugs across federal programs.In 2023, Humira finally faced biosimilar competition in the U.S., yet adoption has lagged compared to Europe. Early data show saving are possible, but manufacturer rebate tactics and entrenched provider practices have slowed uptake. With biosimilars expected for other blockbusters in coming years, stronger incentives and regulatory oversight will be needed to unlock the full savings potential.

Heart and Blood: Cardiovascular Therapies

Blood thinners and heart medications such as Eliquis, Xarelto, and Entresto remain among the top spenders in Medicare Part D and Medicaid due to the high prevalence of cardiovascular disease and the long-term nature of treatment. These therapies illustrate how even widely prescribed, non-specialty drugs can accumulate into massive fiscal burdens when unit costs remain elevated.

Diabetes and Obesity: The GLP-1 Revolution

Medications such as Ozempic, Wegovy, and Mounjaro, originally designed for diabetes but increasingly prescribed for weight loss, are the fastest-growing category of drug expenditures. In 2023 alone, the U.S. government spent nearly $36 billion on diabetes medications — a 300% increase since 2017. Their popularity and therapeutic value make them essential but costly. By 2024, Medicare spending on GLP-1s was rising so sharply it rivaled oncology drugs traditionally one of the largest drivers of federal costs.

While some private insurers have begun restricting coverage due to affordability concerns, federal programs like Medicare, Medicaid, and the VA continue to absorb the cost increases. Analysts now warn that GLP-1 therapies could become the single largest category of drug spending within the next decade if unchecked.

Oncology and Immunosuppressants

Cancer drugs such as Keytruda and Opdivo continue to dominate spending under Medicare Part B. These drugs often cost tens of thousands of dollars per patient annually, and while they provide critical benefits, the absence of negotiation has left Medicare with little leverage to manage escalating costs. Oncology remains the single largest therapeutic category in Medicare Part B and continues to grow year-over-year. These are precisely the kinds of drugs being targeted under Medicare's new price negotiation authority.

Specialty Drugs: Small Patient Populations, Outsized Costs

Beyond the headline categories, specialty drugs for rare diseases and autoimmune conditions also contribute significantly to overspending. Examples include treatments for multiple sclerosis, rheumatoid arthritis, and hepatitis C. While these therapies serve smaller patient populations, their extremely high prices create disproportionately large impacts on federal budgets.

The Numbers Don't Lie: Projected SavingsSource: KFF Analysis of National Health Expenditure (NHE) and OECD Data

Retail prescription drugs now account for roughly 10% of total U.S. healthcare spending, a share among the highest of peer countries — but at a much higher cost base.

r. Aaron Kesselheim of Harvard Medical School puts it plainly: "We are spending more than double what other countries pay, not because our care is better, but because we allow it."

hat if the U.S. government paid fair prices — prices aligned with international norms? The reality is that the fiscal, policy, and health implications of realigning drug prices could save the United States (and taxpayers) up to $241 billion annually without sacrificing innovation or patient care.

he Anatomy of Overspending: Agency by Agency

edicare: The Budgetary Behemoth

edicare, the federal health insurance program for seniors, is the largest purchaser of prescription drugs in the United States. It Medicare Part D, which covers outpatient prescription drugs, accounted for $210 billion in gross spending in 2023. Medicare Part B, which includes physician-administered drugs like chemotherapy agents, reached $35 billion in spending — driven by high-cost biologics such as Keytruda and Prolia.

The 2022 Inflation Reduction Act marked a historic shift by authorizing Medicare to negotiate prices for select high-cost drugs — an effort expected to save nearly $100 billion over a decade. In 2023-2024, CMS released its first list of ten drugs subject to negotiation, including Eliquis, Jardiance, and Stelara. Together, these accounted for more than $50 billion in annual Medicare Part D spending — over 20% of program costs. By 2025, CMS is preparing for a second round of 15 drugs for negotiation, signaling broader reforms ahead.

Medicaid: Chronic Care at a Premium

Medicaid, the joint federal-state insurance program for low-income Americans, spends about $55 billion annually on prescription drugs. Despite mandatory rebates that reduce costs to around 64% of the average wholesale price, Medicaid faves substantial pressure from chronic disease therapies and hepatitis C treatments. Again, it is the taxpayer who ultimately funds these costs.

Recent data shows Medicaid spending on GLP-1 drugs for obesity and diabetes is accelerating rapidly. Several states have urged CMS for stronger rebate protections as GLP-1 coverage threatens to overwhelm state budgets.

Department of Veterans Affairs: A Model of Efficiency

The VA provides care for over 9 million veterans and spends roughly $8 billion annually on prescription medications. Thanks to aggressive negotiation and a streamlined mail-order system, the VA pays about 42% of average market prices — making it a standout in federal drug purchasing and a model for other agencies. This demonstrates that lower prices are possible with the right policies.

Yet, even the VA is now feeling pressure. In FY 2025, it requested an additional $2 billion to specifically cover the costs of weight-loss drugs such as Wegovy — evidence that no federal program is immune to the fiscal impact of this new class of therapies.

Department of Defense: Hidden in the Ranks

With a $55 billion annual health budget, the DoD delivers care through military treatment facilities and the TRICARE program. It benefits from federal pricing programs and discounts, yet comprehensive data on pharmaceutical spending remains opaque. Still, the potential for coordinated taxpayer savings is immense.

Other Federal Programs: Often Overlooked, Still Publicly Funded

While Medicare, Medicaid, the VA, and the DoD account for the vast majority of federal drug expenditures, smaller federal programs such as the Bureau of Prisons (BoP) and Indian Health Service (IHS) also purchase pharmaceuticals using public funds.

Bureau of Prisons (BoP): Provides medications for over 150,000 incarcerated individuals under the Department of Justice. Although the BoP's drug spending is much smaller — estimated in the hundreds of millions — it still represents a taxpayer-funded pharmaceutical expenditure.

Indian Health Service (IHS): Delivers healthcare, including prescription drugs, to roughly 2.6 million American Indians and Alaska Natives. While smaller in budget the IHS must negotiate costs amid systemic underfunding, and drug affordability is a critical issue.

These programs are not typically included in national drug spending summaries, but highlight that the reach of federal pharmaceutical spending is broader than commonly reported. Even beyond the core agencies, smaller federal healthcare programs further reinforce the reality that taxpayers shoulder the cost burden of inflated U.S. drug prices across virtually every corner of government care.

What Drives the Tab: Drug Class Breakdown

Biologics and Specialty Drugs

Biologics such as Humira (for arthritis) and Keytruda (for cancer) are among the most expensive drugs on the market, costing $77,000 and $150,000 annually per patient, respectively. These drugs represent one-third of all pharmaceutical spending and are expected to dominate future budgets.

Biologics such as Humira, Keytruda, and Prolia remain among the most expensive drugs across federal programs.In 2023, Humira finally faced biosimilar competition in the U.S., yet adoption has lagged compared to Europe. Early data show saving are possible, but manufacturer rebate tactics and entrenched provider practices have slowed uptake. With biosimilars expected for other blockbusters in coming years, stronger incentives and regulatory oversight will be needed to unlock the full savings potential.

Heart and Blood: Cardiovascular Therapies

Blood thinners and heart medications such as Eliquis, Xarelto, and Entresto remain among the top spenders in Medicare Part D and Medicaid due to the high prevalence of cardiovascular disease and the long-term nature of treatment. These therapies illustrate how even widely prescribed, non-specialty drugs can accumulate into massive fiscal burdens when unit costs remain elevated.

Diabetes and Obesity: The GLP-1 Revolution

Medications such as Ozempic, Wegovy, and Mounjaro, originally designed for diabetes but increasingly prescribed for weight loss, are the fastest-growing category of drug expenditures. In 2023 alone, the U.S. government spent nearly $36 billion on diabetes medications — a 300% increase since 2017. Their popularity and therapeutic value make them essential but costly. By 2024, Medicare spending on GLP-1s was rising so sharply it rivaled oncology drugs traditionally one of the largest drivers of federal costs.

While some private insurers have begun restricting coverage due to affordability concerns, federal programs like Medicare, Medicaid, and the VA continue to absorb the cost increases. Analysts now warn that GLP-1 therapies could become the single largest category of drug spending within the next decade if unchecked.

Oncology and Immunosuppressants

Cancer drugs such as Keytruda and Opdivo continue to dominate spending under Medicare Part B. These drugs often cost tens of thousands of dollars per patient annually, and while they provide critical benefits, the absence of negotiation has left Medicare with little leverage to manage escalating costs. Oncology remains the single largest therapeutic category in Medicare Part B and continues to grow year-over-year. These are precisely the kinds of drugs being targeted under Medicare's new price negotiation authority.

Specialty Drugs: Small Patient Populations, Outsized Costs

Beyond the headline categories, specialty drugs for rare diseases and autoimmune conditions also contribute significantly to overspending. Examples include treatments for multiple sclerosis, rheumatoid arthritis, and hepatitis C. While these therapies serve smaller patient populations, their extremely high prices create disproportionately large impacts on federal budgets.

The Numbers Don't Lie: Projected Savings

| Agency | Current Spend | OECD Average Price | Estimated Savings |

|---|---|---|---|

| Medicare Part D | $210 Billion | $70 Billion | $140 Billion |

| Medicare Part B | $35 Billion | $12 Billion | $23 Billion |

| Medicaid | $55 Billion | $19 Billion | $36 Billion |

| Veterans Affairs | $8 Billion | $2.7 Billion | $5.3 Billion |

| DoD and Others | $55 Billion | $19 Billion | $36 Billion |

| TOTAL | $363 Billion | $122 Billion | $241 Billion |

Source: Peterson-KFF (2024) and CMS Data

These figures are based on a conservative estimate, aligning U.S. drug prices with the average prices paid in peer countries, and confirm that U.S. taxpayers overspend by more than $240 billion each year compared to peer nations. The disparity is especially striking for biologics and GLP-1 drugs, where American payers often face prices four to five times higher than in Europe and Asia.

The real savings could be even high, particularly if biosimilars are more aggressively adopted or if volume-based contracts are expanded. Importantly, these savings represent dollars returned to taxpayers — money that can be used for deficit reduction, healthcare reinvestment, or relief to working families.

The Path Forward: Reform That Works

To achieve sustainable drug pricing, the following actions are essential:

End Tax Breaks for Pharmaceutical Ads — Pharmaceutical companies have the ability to deduct ad spending from their taxes. Moreover, they often spend billions more on advertising than on research and development. Legislation like H.R. 3010 ends these write-offs and ensures the industry pays its fair share.

Close the Revolving Door — Top officials at the Food and Drug Administration should be confirmed by the United States Senate to increase accountability. Right now, pharmaceutical executives cycle in and out of regulatory roles with little oversight.

Make All Research Public — The Food and Drug Administration, Health and Human Services, Centers for Disease Control, and the National Academies of Sciences, Engineering, and Medicine (as well as related agencies) should be required to publish all taxpayer-funded research, whether results are favorable or not. This transparency helps innovation and builds public trust.

Expand Medicare Negotiation Powers — The power to negotiate drug pricing should move beyond the initial list of 10 drugs and should include all high-costs categories.

Adopt International Reference Pricing — This would allow the United States to tie drug prices to the average paid by other developed countries.

Unify Federal Procurement — By combining the purchasing power of Medicare, Medicaid, the VA, the DoD, and other agencies, the federal government would gain maximum leverage a the negotiation table.

Incentivize Biosimilar Adoption — By streamlining FDA approvals and providing financial incentives, it is possible to shift prescribers away from brand-name monopolies.

Implement Value-Based Pricing — Payments can be linked to real-world treatment outcomes and patient beliefs.

A Defining Fiscal Opportunity

The United States spends more on prescription drugs than any other nation — not because we consume more, but because we pay more. This is not a function of innovation or quality, but of policy. And it is the American taxpayer who ultimately pays the price — subsidizing the pharmaceutical industry's global business model through inflated domestic spending.

If the federal government were to implement international price benchmarking and strategic purchasing reforms, it could save over $240 billion annually. These are not abstract savings — they are tangible, reclaimable dollars that can be redirected for public benefit. With the combined pressures of GLP-1 therapies, patent-cliff biologics, and Medicare's new negotiation powers, we are at a critical inflection point for policymakers to act decisively. It is time for policymakers to defend the interests of the taxpayer and demand fair pricing in return for public funding.

The question is no longer whether we can afford to fix this — but whether we can afford not to.

Rick Westerdale has more than 30 years of experience across the federal government as well as in the global energy industry. As a Vice President at Connector, Inc., a boutique government relations and political affairs firm based in Washington, D.C., Rick advises clients on strategy, investment, and policy across healthcare, hydrocarbons, LNG, hydrogen, nuclear, and the broader energy transition.